A Step-by-Step Guide to Getting Started with Crypto Lending

In the dynamic world of cryptocurrency, lending isn't just an investment strategy; it's also a way to see your assets grow. Whether you're a beginner or have some experience, this article will guide you through the steps to easily step into the realm of cryptocurrency lending.

Step One: Understanding the Basics of Cryptocurrency Lending

Before we begin, let's grasp the fundamental concepts of cryptocurrency lending.

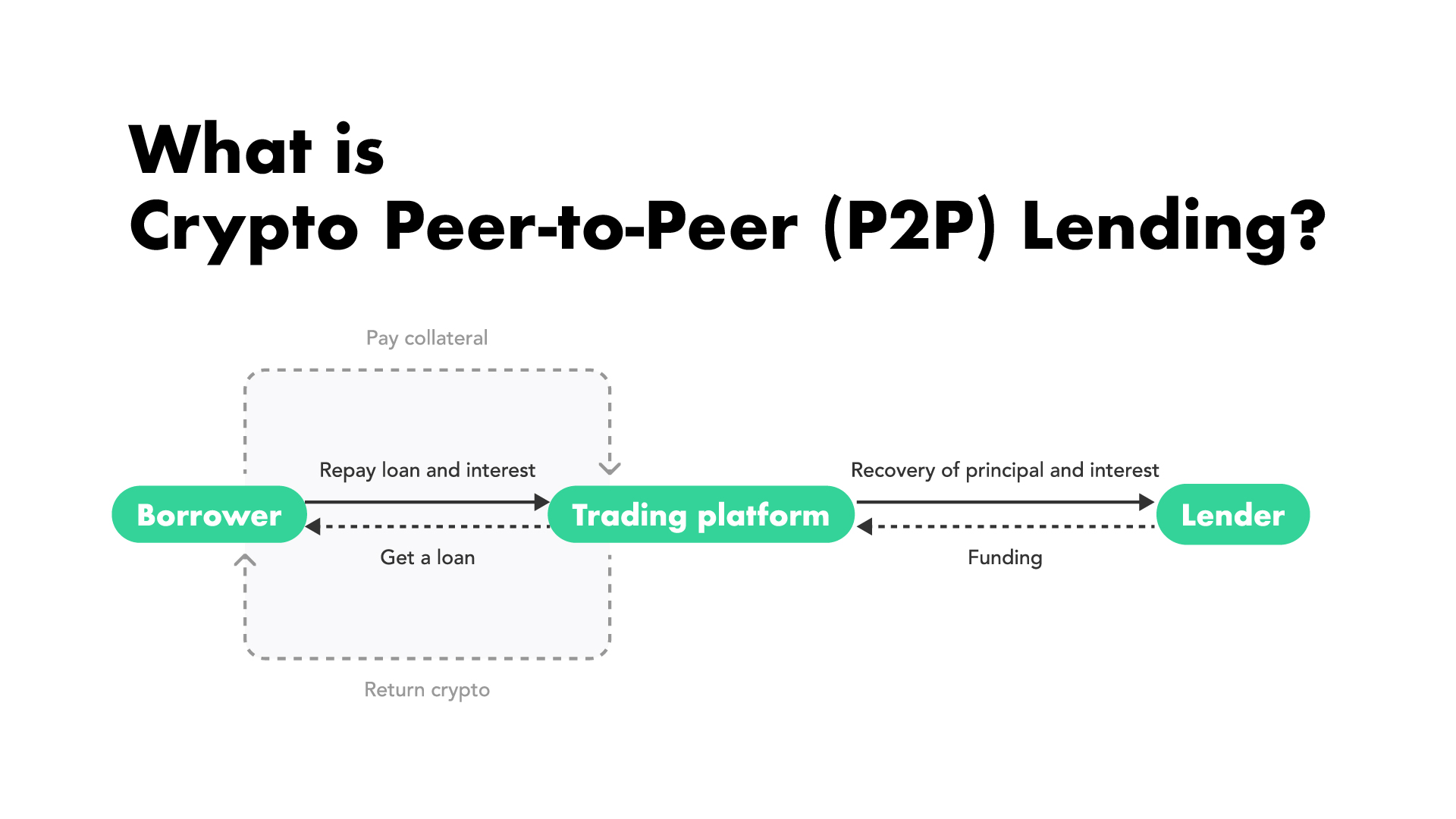

1.1 What is Cryptocurrency Lending?

Cryptocurrency lending involves lending your digital assets to earn interest, providing a means to generate passive income from your digital holdings.

1.2 Difference Between Centralized and Decentralized Platforms

In a centralized system, the entire system is managed and controlled by a central institution or authoritative entity, which possesses absolute control over the system. Traditional banks, financial institutions, and centralized digital currency exchanges are typical representatives of centralized systems. In contrast, in a decentralized system, power and control are distributed among multiple nodes in the network, with no single centralized entity holding all the power. In this model, decision-making and control are collectively maintained by the entire network, and a typical example is blockchain and cryptocurrency, where the Bitcoin network is a decentralized system maintained by nodes globally. In the cryptocurrency domain, decentralization is often seen as providing greater transparency and resistance to censorship. However, some centralized elements still exist, especially at the intersections with traditional financial systems, such as cryptocurrency exchanges.

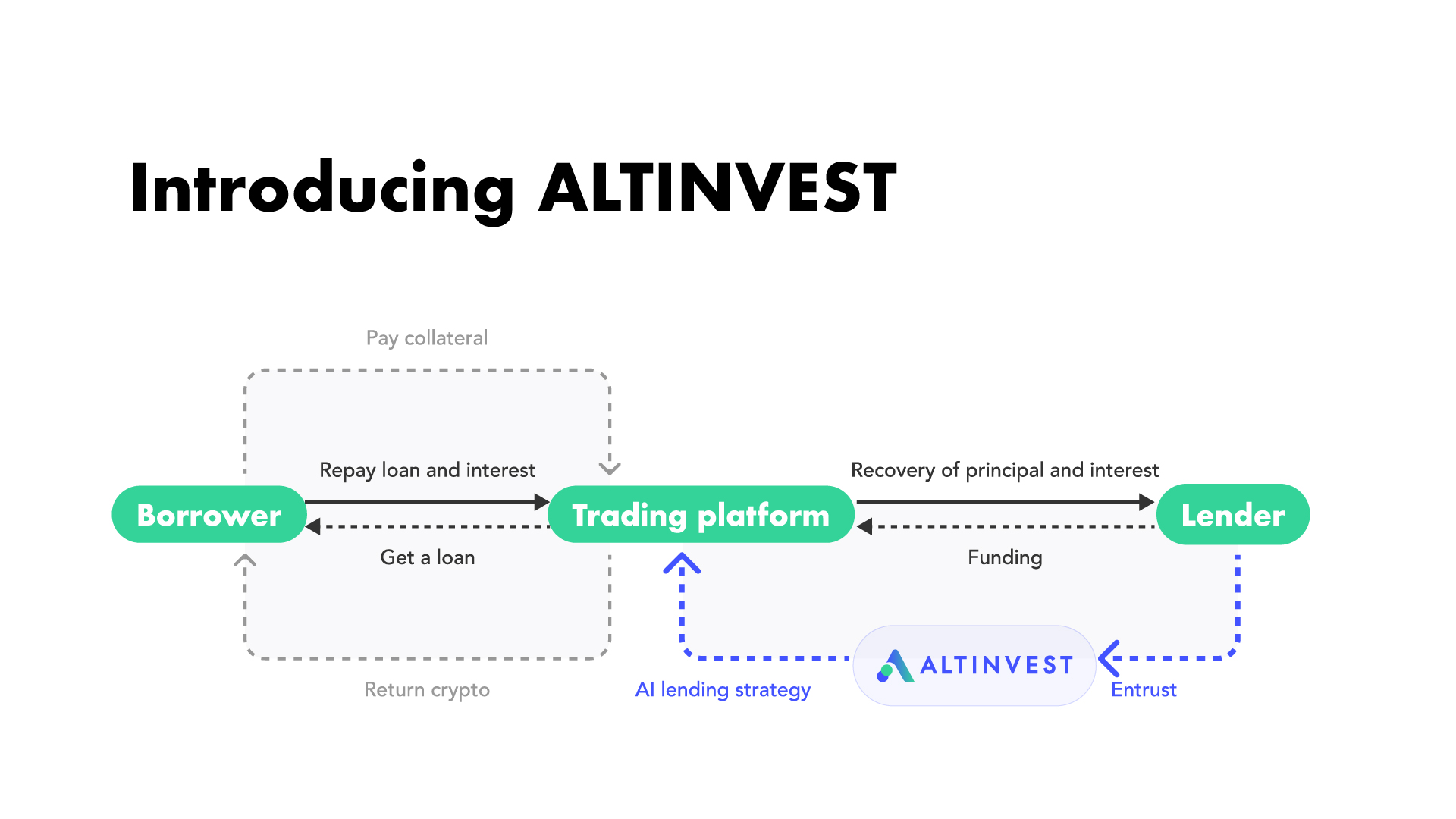

ALTINVEST currently supports Bitfinex exchange, a longstanding cryptocurrency platform with the largest circulating stablecoin, Tether, under the same company. Bitfinex consistently secures top positions on centralized exchange charts.

Step Two: Opening an Account

Now that you've got the hang of the basics of cryptocurrency lending, it's time to dive into the practical side of navigating the cryptocurrency lending field.

2.1 Choose the Right Platform

Explore various cryptocurrency lending platforms, considering factors such as security, supported currencies, and interest rates. Bitfinex supports a variety of cryptocurrencies and fiat currencies as lending targets, along with a relatively strict verification process and risk control system.

➤ Assessing the Security and Reliability of Bitfinex Exchange

2.2 Register and Create an Account

Follow the registration and account creation steps on your chosen platform, ensuring that you understand and complete KYC verification.

➤ How to create an account on Bitfinex ?

➤ How to verify a Bitfinex account?

2.3 Fund Your Account

Transfer your cryptocurrency to the lending platform to prepare for lending.

➤ How to deposit funds to Bitfinex?

➤ How to make a Bank Wire Deposit to Bitfinex?

Step Three: Formulating a Wise Lending Strategy

3.1 Understand Risks and Returns

Thoroughly understand the risks associated in lending while also being aware of the potential returns.

➤ Comparing Crypto P2P Lending with Other Cryptocurrency Investment Strategies

3.2 Select Appropriate Cryptocurrencies

Select suitable cryptocurrencies for lending that align with your investment goals and risk tolerance.

Step Four: Managing and Monitoring Your Investment

4.1 Set Lending Parameters

Set lending parameters, such as interest rates and loan terms, to your specific needs and preferences.

4.2 Regularly Monitor Your Portfolio

Frequently review your lending investment portfolio and make adjustments as needed, considering market conditions.

Step Five: Extracting Profits and Reinvesting

5.1 Extract Profits

Learn how to withdraw your lending profits and enjoy your passive income.

➤ How to withdraw crypto from Bitfinex?

➤ How to make a Bank Wire Withdraw at Bitfinex?

Conclusion

Armed with this guide, you're equipped to embark on your cryptocurrency lending journey. Remember, this field evolves rapidly, so staying informed and adapting to market shifts are crucial for success.