Exploring Crypto Investment Strategies

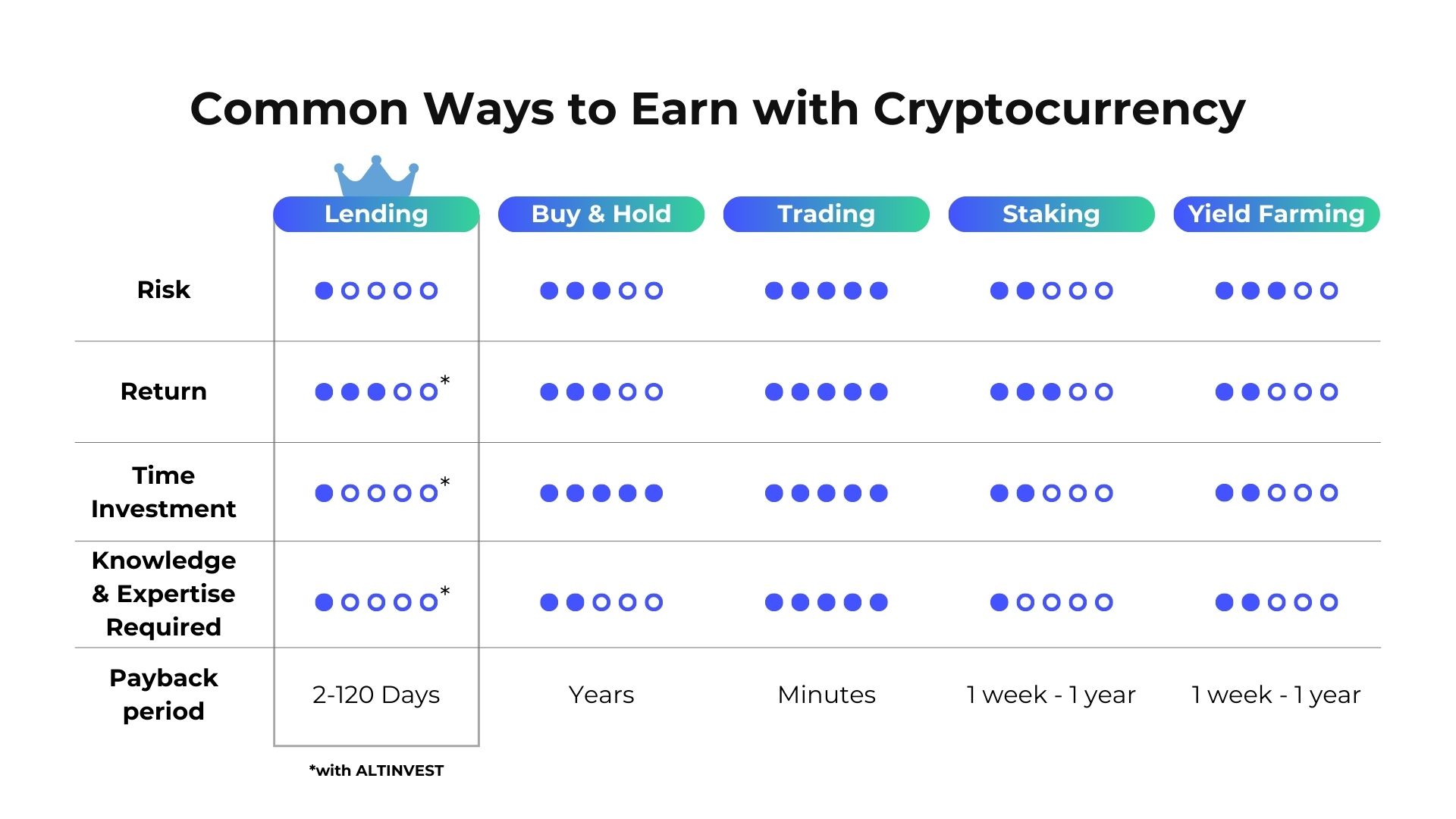

Cryptocurrency investments offer a myriad of opportunities, each with its unique advantages and challenges. This article delves into popular strategies like HODLing and trading while also exploring the innovative worlds of crypto lending, staking, and yield farming.

HODLing : The Time-Tested Investment Approach

HODLing involves buying cryptocurrencies and holding onto them for the long term. It’s a strategy based on patience and long-term market growth.

| Pros of HODLing | Cons of HODLing |

Long-Term Potential : Historically, the crypto market has shown significant long-term growth. | Price Volatility : HODLers are exposed to market fluctuations without actively capitalizing on them. |

Minimal Active Management : Requires less time and effort compared to active trading. | Lack of Liquidity : Accessing funds may not be as immediate as with other strategies. |

Tax Benefits : In some regions, long-term holdings may qualify for favorable tax rates. |

Trading : Seizing Opportunities in Volatile Markets

Trading involves buying and selling cryptocurrencies to profit from short-term price movements. Traders use various strategies and analysis methods.

| Pros of Trading | Cons of Trading |

Quick Gains Potential : Traders can profit from both upward and downward market movements. | High Risk : Crypto markets are highly volatile, leading to potential losses. |

Active Management : Allows real-time reactions to market developments. | Emotional Stress : Rapid decision-making can lead to stress and anxiety. |

Diverse Strategies : Day trading, swing trading, and more cater to different risk appetites. | Expertise Required : Successful trading demands a deep understanding of market analysis. |

Crypto Lending : Earning Passive Income Through Loans

Crypto lending platforms enable users to lend their digital assets to borrowers in exchange for interest payments, generating passive income.

| Pros of Crypto Lending | Cons of Crypto Lending |

Passive Income : Earn interest without active trading, creating a steady income stream. | Counterparty Risk : Borrowers might default, leading to potential losses. |

Risk Diversification : Spread investments across borrowers and assets for diversification. | Platform Trust : Relies on trust in the lending platform; due diligence is essential. |

Predictable Returns : Offers predictable income streams through lending activities. |

Staking : Participating in Network Security and Earning Rewards

Staking involves actively participating in transaction validation on a Proof-of-Stake blockchain network, often earning rewards.

| Pros of Staking | Cons of Staking |

| Earn Passive Income : Receive staking rewards for supporting network operations. | Locked Funds : Staked tokens are usually locked up for a specific period, limiting liquidity. |

| Network Participation : Contribute to the security and functionality of the blockchain. | Market Volatility : Staking rewards might fluctuate based on market dynamics. |

| Potential for High Rewards : Some networks offer attractive staking rewards, especially in newer projects. |

Yield Farming : Optimizing Returns in Decentralized Finance (DeFi) Protocols

Yield farming involves leveraging various DeFi protocols to maximize returns on crypto assets, often through liquidity provision.

| Pros of Yield Farming | Cons of Yield Farming |

| High APY (Annual Percentage Yield) : Some yield farming opportunities offer exceptionally high returns. | Complexity : Involves navigating various DeFi platforms and protocols, which can be daunting for beginners. |

| Additional Token Rewards : Yield farmers may receive additional project tokens as incentives. | Impermanent Loss : Providing liquidity might result in potential losses due to price volatility. |

| Flexible Opportunities : Multiple DeFi projects and protocols offer diverse yield farming strategies. | Smart Contract Risks : Vulnerabilities in smart contracts can lead to financial losses. |

Conclusion

Choosing the right crypto investment strategy depends on your risk tolerance, financial goals, and level of involvement. HODLing offers long-term stability, trading provides active engagement, crypto lending ensures passive income, staking contributes to network security, and yield farming maximizes returns within the DeFi ecosystem. Each strategy has its pros and cons, making it crucial to conduct thorough research and assess your comfort level before making investment decisions.

Disclaimer

Cryptocurrency investments are inherently risky and should be approached with caution. Past performance does not guarantee future results. Always conduct extensive research and consult with financial professionals before making investment decisions.