Will Bitfinex Close Down? Evaluation of Exchange Security and Reliability

Future Prospects of Bitfinex Exchange: A Question of Longevity?

Among a multitude of cryptocurrency exchanges, Bitfinex, with its established history and impressive operational performance, continues to offer safe and reliable services for investors. However, every investor faces a critical consideration when selecting an exchange platform: is there a risk of this exchange collapsing? This article will investigate the trustworthiness of Bitfinex, examining its corporate history, operational health, market influence, and handling of past incidents.

Company Longevity: A Testament to Trust

Firstly, the foundation of Bitfinex provides us with a valuable cornerstone of trust. Since its establishment in 2012, Bitfinex has stalwartly operated for over a decade—a rare lifespan in the fast-paced world of cryptocurrency exchanges. The founders and operations team of Bitfinex possess profound experience and expertise, enabling the exchange to remain competitive in the ever-evolving digital currency market. (Source: 1、2)

Analyzing Bitfinex's Profitability and Operational Health

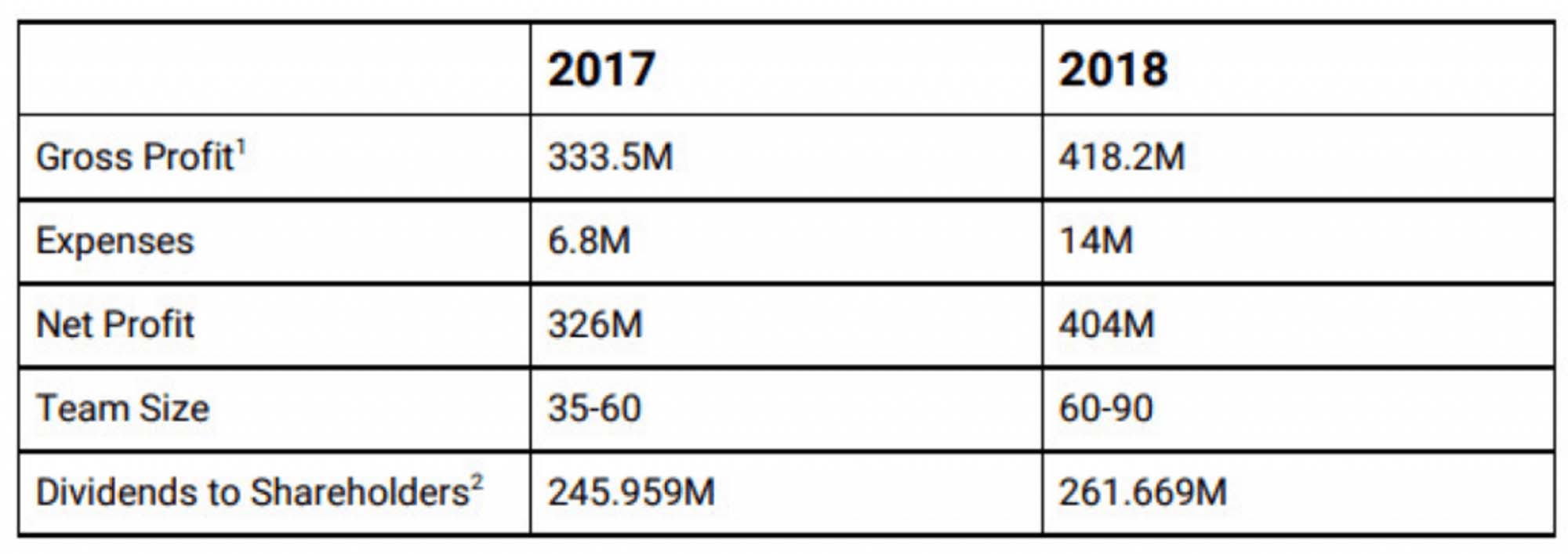

Secondly, from an operational perspective, Bitfinex's performance is nothing short of impressive. Although Bitfinex has not publicly disclosed specific revenue data, we can make rough estimations based on information about transaction volume and service fees. Importantly, despite previous over-issuance incidents involving USDT and subsequent freezing of funds by New York prosecutors, the company successfully raised funds through an Initial Coin Offering (ICO) of LEO tokens. This activity not only brought in revenue but also marked the first public disclosure of the company's financial situation with the release of its fundraising whitepaper.

According to Bitfinex's whitepaper on issuing LEO tokens, the company achieved a revenue of $330 million in 2017, with operational costs under $7 million. In the following year, despite a downturn in the cryptocurrency market, Bitfinex still managed to reach a revenue of $400 million, showcasing the company's solid and sustained growth trajectory. With a team of fewer than 100 members, achieving an output of over $4 million per employee not only verifies Bitfinex's strong earning power, but it also reflects the company's operational efficiency.

An Examination of Bitfinex's Market Influence in the Industry

A company's profitable performance doesn't ensure its survival if its industry influence is insignificant. Any market fluctuation could potentially lead to the company's collapse. Hence, maintaining influence and standing in the market is a vital factor for a company's long-term operation. This explains why some major companies, facing operational crises, sometimes require government intervention for rescue.

In the cryptocurrency market, Bitfinex resolved the challenging issue of capital preservation by issuing the USDT, a stablecoin pegged to the US dollar. This has created a significant impact in the market. Before the advent of USDT, the process of converting cryptocurrency into fiat money was fraught with difficulties. However, with USDT, investors can transform their profits into USDT equivalent in value to US dollars but with lesser volatility, thereby preserving their earned profits.

USDT has the largest circulation in the global cryptocurrency market, accounting for 39% of the total, meaning 39 out of every 100 units of transactions are conducted with USDT. Its circulation even surpasses the well-known Bitcoin, enabling more users. Since Bitfinex's subsidiary, Tether, holds the issuance rights of USDT, Bitfinex is sometimes humorously referred to as the "underground central bank" of the cryptocurrency market. This influence suggests that a collapse of Bitfinex might deliver a significant blow to the entire cryptocurrency market.

Analyzing Bitfinex's Handling of Past Incidents

Bitfinex has shown respect for customer rights and professional crisis management abilities when dealing with past major incidents.

In 2016, Bitfinex suffered a Bitcoin theft incident, resulting in a loss of assets worth approximately $72 million, leading to an average member asset loss of 36%. Unlike most exchanges that choose to collapse or evade responsibility after substantial losses, Bitfinex chose to bear the responsibility and pledged to compensate member losses with its monthly revenue.

Over the following eight months, Bitfinex successfully compensated all losses, paying out approximately $9 million in operating profits per month. For the scale of losses at that time, this is not something a small exchange could typically handle. Yet Bitfinex achieved this and provided the compensated members with decent returns afterwards. This demonstrates Bitfinex's commitment to crisis management and the protection of member rights, earning it a high degree of trust. (Related Report: 1、2)

In conclusion, Bitfinex exchange, with its rich historical background, robust operational health, substantial market influence, and proven ability to adapt and resolve issues during past upheavals, can be considered a safe and reliable cryptocurrency exchange. By taking all these factors into account, we can confidently state that Bitfinex is a trustworthy platform for cryptocurrency trading.