Real-World Assets (RWA) and Tokenized Asset Funds: An Overview

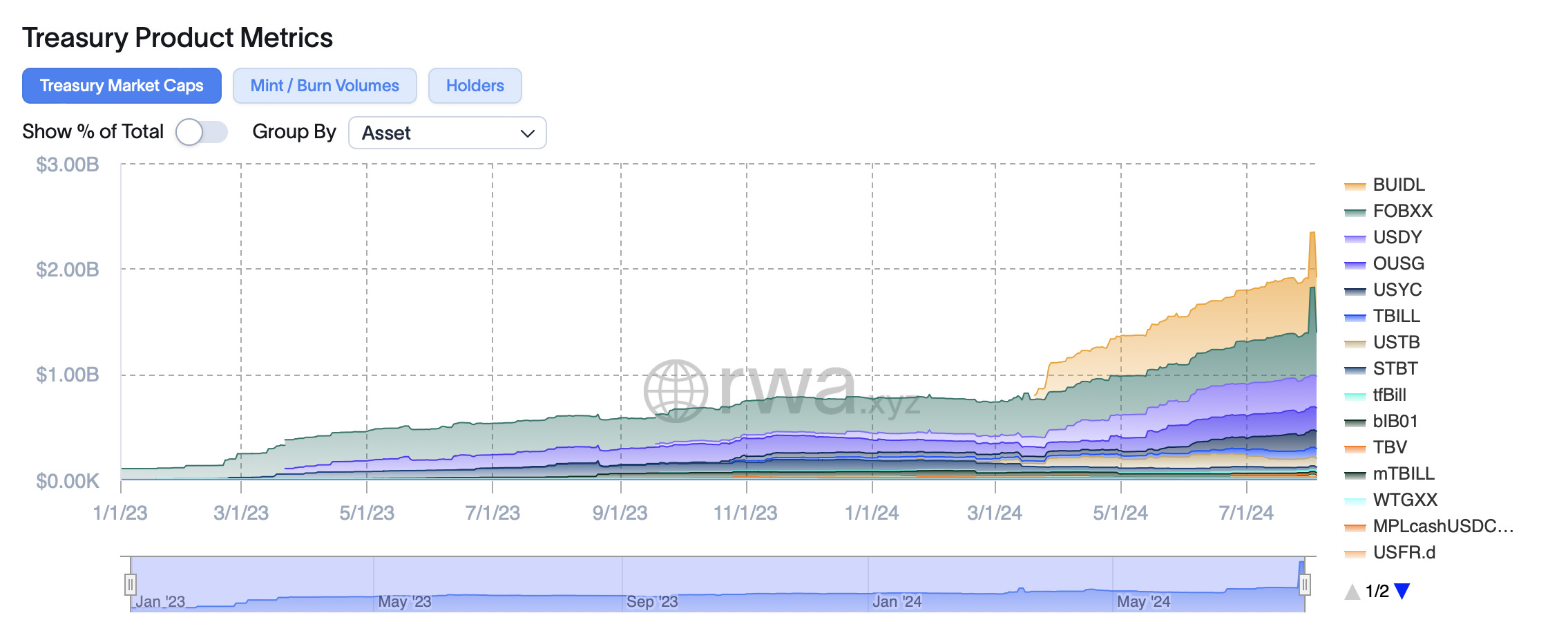

In recent months, BlackRock's BUIDL fund has become a sensation in the financial world. Just three months after launched, it has already amassed over $50 million in assets. This remarkable success highlights the growing interest in real-world assets (RWA) and the innovative approaches to investing in them through tokenized asset funds.

What are RWAs?

Real-world assets (RWAs) refer to tangible, physical assets that have intrinsic value. These can include real estate, commodities like gold and oil, art, and even intellectual property. Unlike digital assets such as cryptocurrencies, RWAs are grounded in the physical world, providing a stable and often less volatile investment option.

How RWAs are Tokenized

Tokenization of RWAs involves converting the rights to an asset into a digital token on a blockchain. This process starts with the identification and valuation of the asset. Next, a digital representation of the asset is created in the form of a token. This token is then issued on a blockchain platform, allowing it to be bought, sold, and traded. The key benefits of tokenization include increased liquidity, fractional ownership, and enhanced transparency.

Examples of Tokenized RWA Applications

- Centralized Stablecoins: Stablecoins like USDT and USDC are pegged to real-world assets such as the US dollar. These digital currencies maintain their value by holding reserves of the corresponding assets, providing stability in the volatile crypto market.

- Real Estate: Tokenizing real estate allows investors to own a fraction of a property. This democratizes access to high-value real estate investments and enhances liquidity, as tokens can be easily traded on secondary markets.

- Art and Collectibles: High-value artworks and collectibles can be tokenized, enabling fractional ownership. This opens up the market to a broader range of investors who can now own a piece of a valuable item without purchasing it outright.

- Precious Metals: Gold, silver, and other precious metals can be tokenized, allowing investors to buy, sell, and trade digital representations of these assets. This provides a more efficient and secure way to invest in commodities.

- Carbon Credits: Tokenizing carbon credits can streamline the process of trading these credits and enhance transparency. This can support efforts to combat climate change by making it easier for companies to buy and sell carbon offsets.

Introducing BlackRock’s BUIDL Fund

The BUIDL fund, officially known as the BlackRock USD Institutional Digital Liquidity Fund, marks a significant advancement in the integration of traditional finance with blockchain technology. Launched on March 21, 2024, on the public Ethereum blockchain, the BUIDL fund represents BlackRock's foray into the world of tokenized financial assets.

The BUIDL fund is designed to invest primarily in "cash-like" USD assets, such as cash, short-term U.S. government bonds, and overnight repos. It aims to maintain a stable value of $1 per BUIDL token.

The fund manages investments by converting traditional assets into tokenized forms on the blockchain. Each BUIDL token represents fractional ownership of the underlying assets. This allows investors to benefit from the stability and liquidity of cash-like assets while leveraging blockchain technology for enhanced efficiency.

Operational Mechanism

Securitize LLC is responsible for the tokenization process and regulatory compliance of the BUIDL fund. They convert traditional financial assets into blockchain-based tokens and manage the transfer and reporting of these tokens.

The BUIDL fund offers 24/7/365 subscription and redemption services. This on-chain instant settlement capability addresses inefficiencies in traditional fund operations, where transactions often face delays and require multiple intermediaries.

Advantages

- Real-Time Transactions: The fund uses blockchain technology to enable real-time settlement and reduce transaction costs. This innovation provides investors with immediate access to their investments and simplifies fund management processes.

- Regulatory Compliance: The BUIDL fund is compliant with SEC regulations and follows strict KYC/AML procedures. It operates as a permissioned ERC-20 token, ensuring security and regulatory adherence.

Conclusion

The introduction of BlackRock's BUIDL fund signifies a transformative step in the integration of traditional finance and blockchain technology. By combining the stability of cash-like assets with the advantages of tokenization, the BUIDL fund sets a new precedent for financial innovation.

Looking ahead, the model established by BUIDL could serve as a blueprint for other financial institutions exploring tokenization. This evolution not only enhances liquidity and efficiency but also opens new opportunities for managing and investing in real-world assets, paving the way for further advancements in the financial sector.