Generating a $1,500 Monthly Passive Income with 100K Capital: The Complete Strategy to USD Lending on Bitfinex

Unlocking 20% Annual Return USD High-Yield Loan with Just 1 Hour of Effortless Setup

While it may sound too good to be true, or even resemble a scam. But rest assured, it's simply an investment method few are aware of, yet has already proven lucrative for some. And here's the kicker: You don't actually need to part ways with$1 million to enjoy a 20% annual return. The minimum investment? Just $150. It's merely a headline designed to grab your attention.

This article will be divided into three sections, addressing your possible concerns and questions.

- Why is the rate of return so high?

- Is the risk high? Will I lose all my money?

- What’s required to start?

What’s Behind Such High Rate of Return?

This happens because most of your dollars are lent out to invest in cryptocurrencies. Cryptocurrency markets are known for their high volatility, a fact familiar to seasoned investors in the crypto space. When the cryptocurrency market bull run kicks off, almost every purchase seems profitable (provided you exit at the right time). Additionally, there are often outstanding investment opportunities arising from information asymmetry. Even with high-interest rates, as long as investors believe they can outperform the interest, borrowing money for investment naturally seems justified.

Borrowing Dynamics and Market Volatility

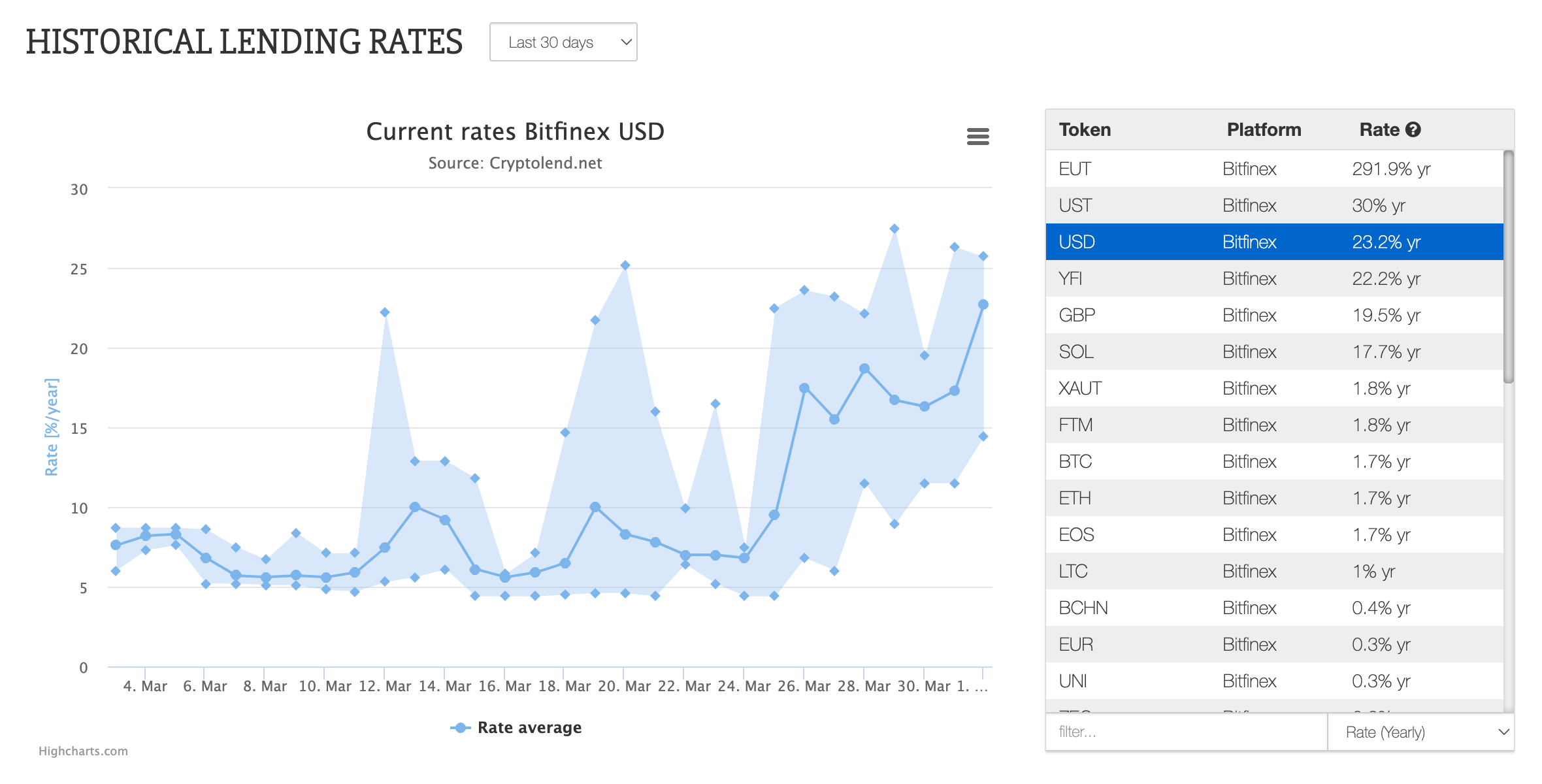

Another crucial point is that investors engaged in margin trading typically operate as short-term players, with relatively brief borrowing periods. Based on our observations on the lending conditions, most borrowers only borrow for 2 days at a time. As of the date of writing this article, the daily interest rate for lending USD/USDT on Bitfinex hovers around0.063% (equivalent to an annualized return of approximately 23%). Borrowing for 2 days incurs only 0.126% in interest. For investors who can accurately navigate market fluctuations, covering this interest is quite manageable.

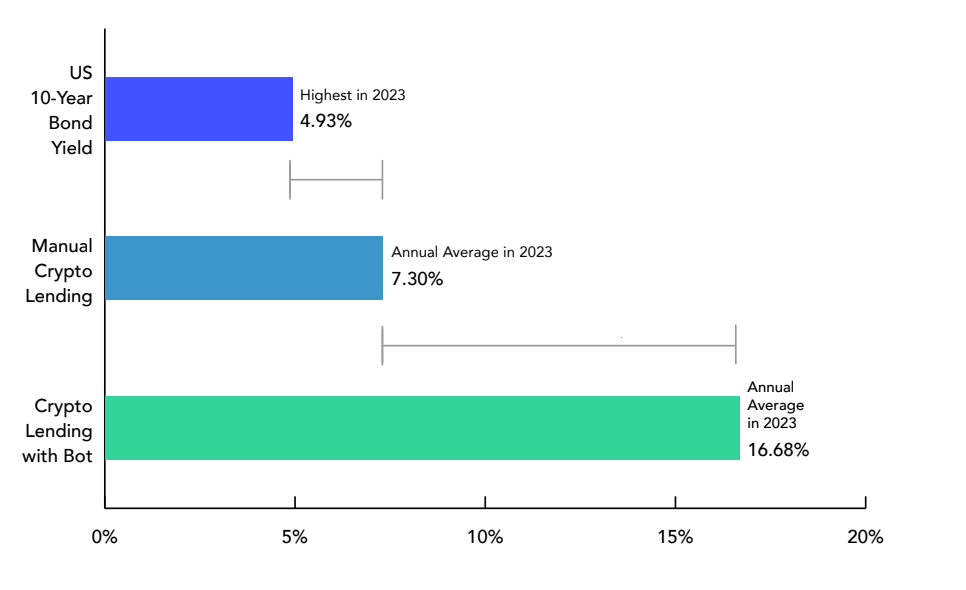

Comparison of Return Rates : Traditional Finance vs Crypto Lending

The graph below illustrates the 2023 return rates comparison among the US 10-Year Bond Yield, Manual Crypto Lending, and Crypto Lending with Bot. The US 10-Year Bond Yield peaked at 4.93%, whereas Manual Crypto Lending yielded 7.30%, marking a 2.37% increase. With the integration of a Crypto Lending Bot, the return rates skyrocketed to 16.68%, showcasing a staggering 9.38% boost solely attributed to the utilization of lending bots. This significant improvement underscores the potential for enhanced returns through automated lending strategies in the cryptocurrency market.

The Role of ALTINVEST’s Automated Lending Strategies

Next, you might be wondering, with such short borrowing periods each time, wouldn't it mean users have to be constantly putting up orders to ensure the annualized return? Absolutely, and that's where ALTINVEST comes in.

ALTINVEST utilizes strategic lending bots to automate lending management efficiently. This ensures that funds remain predominantly in lending status with minimal downtime (typically only a few hours at most), while also securing competitive interest rates. By eliminating constant market monitoring and manual lending, ALTINVEST allows users to optimize their lending activities effortlessly. With its sophisticated algorithms and self learning capabilities, ALTINVEST adapts to market conditions in real-time, maximizing returns while minimizing efforts. This streamlined approach empowers users to focus on strategic decision-making rather than mundane operational tasks, ultimately enhancing their overall lending experience.

Risk Analysis on Lending and Bitfinex

Such high annualized returns definitely don't come without risks, but upon careful consideration, you'll find that the level of risk is actually quite reasonable and acceptable.

Collateral Requirements

Why? Well, borrowing funds for investment on Bitfinex requires collateral. For example, if Bitcoin is used, borrowers must meet an initial margin requirement of 111.11%. So, for a $900 loan, $1,000 worth of BTC is required as collateral. If the collateral's value drops below the minimum maintenance margin, forced liquidation occurs, and funds are returned to the lender.

Algorithms and Risk Mitigation

Bitfinex employs algorithms to mitigate the risk of rapid market fluctuations leading to uncontrollable forced liquidations, a scenario never encountered before. These algorithms slow down liquidations to align with bids/asks in the order book. While intended to prevent catastrophic losses, in theory, margin traders could still incur losses exceeding their collateral. Bitfinex initially covers losses up to a certain threshold, yet if a significant portion of margin positions plunge below zero due to extreme price shifts, losses may be distributed among margin funding providers, though this scenario remains hypothetical in Bitfinex's operational history.

Platform Stability

Once we've delved into the risks associated with lending, it's natural to question the platform's stability. Established in 2012, Bitfinex stands as one of the oldest and most prominent cryptocurrency exchanges worldwide. Comparing it to traditional financial markets, if Binance holds the rank of the New York Stock Exchange, Bitfinex is akin to the esteemed London Stock Exchange. A collapse of Bitfinex would send shockwaves throughout the cryptocurrency realm, especially given its pivotal role as the issuer of the largest stablecoin, USDT.

Readers are suggested to refrain from investing their life savings in this venture. For those inclined towards risk aversion, a US stock ETF with an annual return of approximately 7% may be more suitable. It's unrealistic to expect returns of 15-20% annually (with minimal risk to the principal) while aiming for investment in a mature and regulated environment.

Ready to Lend? Let's Get Started!

To kickstart your lending journey on Bitfinex with ALTINVEST, you'll need two key ingredients: a verified Bitfinex account containing at least $150 USD and an ALTINVEST account connected to your Bitfinex API Key.

For Existing Bitfinex Users

For existing Bitfinex users who are already familiar and able to deposit fiat currency, getting started with lending will be quite straightforward and quick. Simply create an ALTINVEST account and connect it with your Bitfinex API.

For Complete Beginners

Before you can start lending, you'll need to spend some time completing KYC (Know Your Customer) procedures and get verified. Discover the complete roadmap and everything you need in our article, A Comprehensive Beginner’s Guide : How to Start Using ALTINVEST. This guide is packed with step-by-step tutorials, covering everything from creating an account and making a deposit to choosing a plan. It's your ultimate resource to kickstart your lending journey like a pro!

Summary

In summary, crypto lending presents a unique opportunity for investors seeking higher returns in the cryptocurrency market while maintaining stability. It caters to individuals who are looking to diversify their investment portfolios beyond traditional assets and capitalize on the potential of digital currencies. ALTINVEST is particularly suitable for those who already hold USD but are unsure how to maximize their returns or are aiming for financial independence and early retirement (FIRE).

Benefits of Lending on Bitfinex with ALTINVEST

- Automated Efficiency : Streamlines the lending process by eliminate constant market monitoring and manual lending.

- Higher Returns : Investors can enjoy attractive returns of up to 20% without the need for extensive manual intervention, allowing for passive income generation.

- Flexible Cashflow : With short lending periods, funds are not locked away for extended periods, providing users with flexibility and liquidity.

- Relatively Stable Passive Income : Lending on Bitfinex offers a relatively stable passive income stream and a reasonable risk to return ratio, especially when compared to other cryptocurrency investments, providing investors with peace of mind.

Whether you're aiming for higher returns, flexible cashflow, or stable passive income, ALTINVEST offers a user-friendly platform and automated tools to help you achieve your financial objectives in the cryptocurrency lending space. Unlock the potential of lending on Bitfinex with ALTINVEST and claim your 2-week free trial. Join our Telegram group for community support and insights along the way!

To get started with $100, join our giveaway! Here's what you need to do:

- Sign up on ALTINVEST website

- Join our Telegram group where we provide daily crypto news updates

- Follow us on X

- Retweet this tweet

- Complete the task form

This giveaway will run until 14 July, 2024. Simply follow these steps and complete the Google Form. Your account will be credited with the reward once the giveaway ends and details are verified.