What Makes a Good Bitfinex Lending Bot?

In the fast-paced crypto market, manually managing lending orders often fails to keep up with rapidly changing interest rates and borrowing demand. Lending bots, which connect to Bitfinex via API, can instantly retrieve market interest rates, volumes, and other data, and place orders based on preset strategies. This means users don’t need to constantly monitor the market; the bot can adjust lending conditions in real-time according to the latest trends and seize brief opportunities for high interest rates. These bots enable users to earn passive income: users only need to link their API keys, and the bot will execute lending operations around the clock. The user’s principal and interest remain in their own account at all times, ensuring both transparency and fund security. Lending bots not only improve lending efficiency but also enhance income potential, making them a popular tool among crypto investors. Below are key features to consider when evaluating Bitfinex Lending bots.

Dynamic Interest Rate Strategies

Historical Rate Analysis and Market Supply-Demand Interpretation

A high-performing lending bot typically uses Bitfinex APIs to access real-time and historical interest rate data and analyzes the borrowing market's supply and demand. By comparing past rate trends and volumes, the bot can determine whether the current rate is relatively high or low and adjust its bid accordingly. For example, when demand is high, lending rates usually rise, so the bot can increase the order rate; conversely, it can lower the rate to ensure funds are lent out during low demand. This market-responsive strategy helps lenders steadily pursue optimal returns.

Mechanism for Automatically Adjusting Order Rates

Modern lending tools usually offer multiple automated lending modes. Some bots implement strategies such as: canceling and relisting orders at lower rates when the market drops, or concentrating funds on longer-term loans when demand spikes and rates soar, thus increasing fee income. Bots are designed to continually optimize interest rates to match quickly with borrowers. They also allow users to customize parameters such as minimum/maximum rates and reserve ratios. These dynamic pricing strategies increase the chance of order fulfillment and boost returns across various market conditions.

Actual Impact on Lending Returns

The core purpose of dynamic interest rates is to enhance overall yield. In theory, lowering the rate at the right time reduces idle time and increases the chance of matching; when high-rate borrowing demand arises, placing larger long-term orders boosts average returns. For instance, a strategy might use short-term 2-day lending initially, then switch to longer-term orders when high-interest demand appears. In comparison, Bitfinex’s FRR (Flash Return Rate)—an hourly weighted average rate—cannot instantly reflect extreme market conditions. Flexible rate adjustments by bots often strike a better balance between profit and risk, resulting in higher yields than relying solely on FRR or fixed rates.

Automated Order and Reposting Mechanism

The Process of Placing, Monitoring, and Canceling Orders

Well-designed bots automatically place funding orders via the Bitfinex API, monitor their status, and cancel them when needed. For example, bots submit funding offers via API and continuously check whether they’ve been filled. If orders remain unfilled for a long time or become uncompetitive due to market changes (e.g., falling rates), the bot cancels them and reposts with better terms. This ongoing cycle of placing—checking—canceling ensures lending offers stay close to the market’s best rates, maximizing fund utilization.

Redeploying Funds After Repayment

Once a borrower repays, the bot reinvests the returned funds into new loans to maximize returns. In other words, once the account receives interest and principal, they’re immediately allocated into new lending orders. This creates a compounding effect, allowing each payment to be put to work right away. With just a one-time setup, users can enjoy growing returns without manual intervention.

Keeping Funds Fully Utilized

The essence of compounding is minimizing idle capital. Through multiple orders and 24/7 automation, bots ensure funds are lent out as soon as there’s an opportunity. For example, by distributing funds across various interest rates and loan durations, bots greatly improve the chances of matching. Also, when loans are repaid, bots instantly place new offers, avoiding idle capital. Compared to manual operation, bots can significantly improve fund utilization and help users earn interest on interest.

Fund Diversification and Position Management

Benefits of Splitting Funds into Smaller Orders

Breaking funds into smaller orders is a common practice with several advantages: first, small orders are more likely to be partially filled when market demand changes, avoiding a situation where a large single order remains unmatched; second, they increase the chance of matching with multiple borrowers. Additionally, diversification reduces the risk of return loss due to prolonged inactivity of large orders. Therefore, smaller and more frequent orders improve match rates and diversify risk, positively impacting returns.

Position Distribution Across Rate Ranges and Durations

A good lending bot allocates funds across different interest rates and durations. For example, some funds might be placed at lower rates with shorter terms (2–7 days) for quick turnover, while others are placed at higher rates and longer terms to lock in higher returns. By diversifying across interest rates and durations, investors can both ensure fast lending and capture occasional spikes. This multi-layered strategy improves fund efficiency and overall matching rates.

Boosting Fund Utilization and Match Probability

The goal of diversified positions is to enhance fund usage and match probability. For instance, placing all funds in a single high-rate, long-term order may result in idle capital if there are no borrowers. Multiple orders with different terms prevent this. 24/7 automated lending ensures that users’ intended capital is constantly in use. By combining diversification and dynamic order techniques, bots help minimize idle funds and achieve steady lending growth.

Risk Management Mechanisms

Pausing During Extreme Market Volatility

While lending is relatively low-risk, extreme market conditions can introduce uncertainty due to borrower liquidations. A robust bot should include risk control features that pause new lending during high volatility or reduce the available balance ratio to minimize losses. For example, during a sudden crypto crash, halting the bot helps prevent lending under unfavorable conditions. The ability to adjust strategy proactively during risky periods is a key part of effective risk control.

Maximum Loan Duration and Idle Rate Control

Users can also set a maximum loan duration to avoid funds being locked in low-interest loans for too long. Most borrowing demand is short- to mid-term, so overly long loans may hinder liquidity. Alongside this, bots can limit idle ratios—e.g., keeping a small portion of funds idle as a reserve for emergencies or sudden market shifts. These controls help balance returns and liquidity, ensuring flexibility across market conditions.

Avoiding Risk Concentration

Finally, good risk management avoids concentrating too much capital in a single loan or currency. Bitfinex itself requires borrowers to maintain collateral to reduce credit risk, but users should also diversify—for example, by setting per-loan limits to prevent a single loan from consuming too much capital. This minimizes the impact of borrower defaults or liquidations. By diversifying loan targets and amounts, along with using risk control strategies, users can effectively pursue returns while mitigating potential risks.

API Performance and Stability

Impact of Latency on Returns

In a high-frequency trading environment, transaction latency directly affects lending performance. If system latency is high, it may miss the best timing to place orders. For example, when interest rates suddenly change, if the bot's order updates are not timely enough, other faster orders may execute first, reducing returns. Therefore, a good bot strives to minimize API latency by using low-latency servers, optimizing network connections, and ensuring efficient concurrent processing. In fact, time delays in lending markets can translate into rate gaps and have a tangible impact on final profits.

Maintaining High Availability and Error Retry Mechanisms

API stability is crucial for continuous bot operation. Bitfinex imposes strict rate limits on frequent requests; exceeding these will return errors and temporarily block further requests. Thus, bot designs must include error retry mechanisms and comply with these limits carefully. They also need automatic reconnection and data synchronization capabilities during network or server failures to ensure lending strategies run steadily over the long term, thereby maximizing user returns.

Monitoring and Reporting Features

Real-Time Monitoring Dashboards

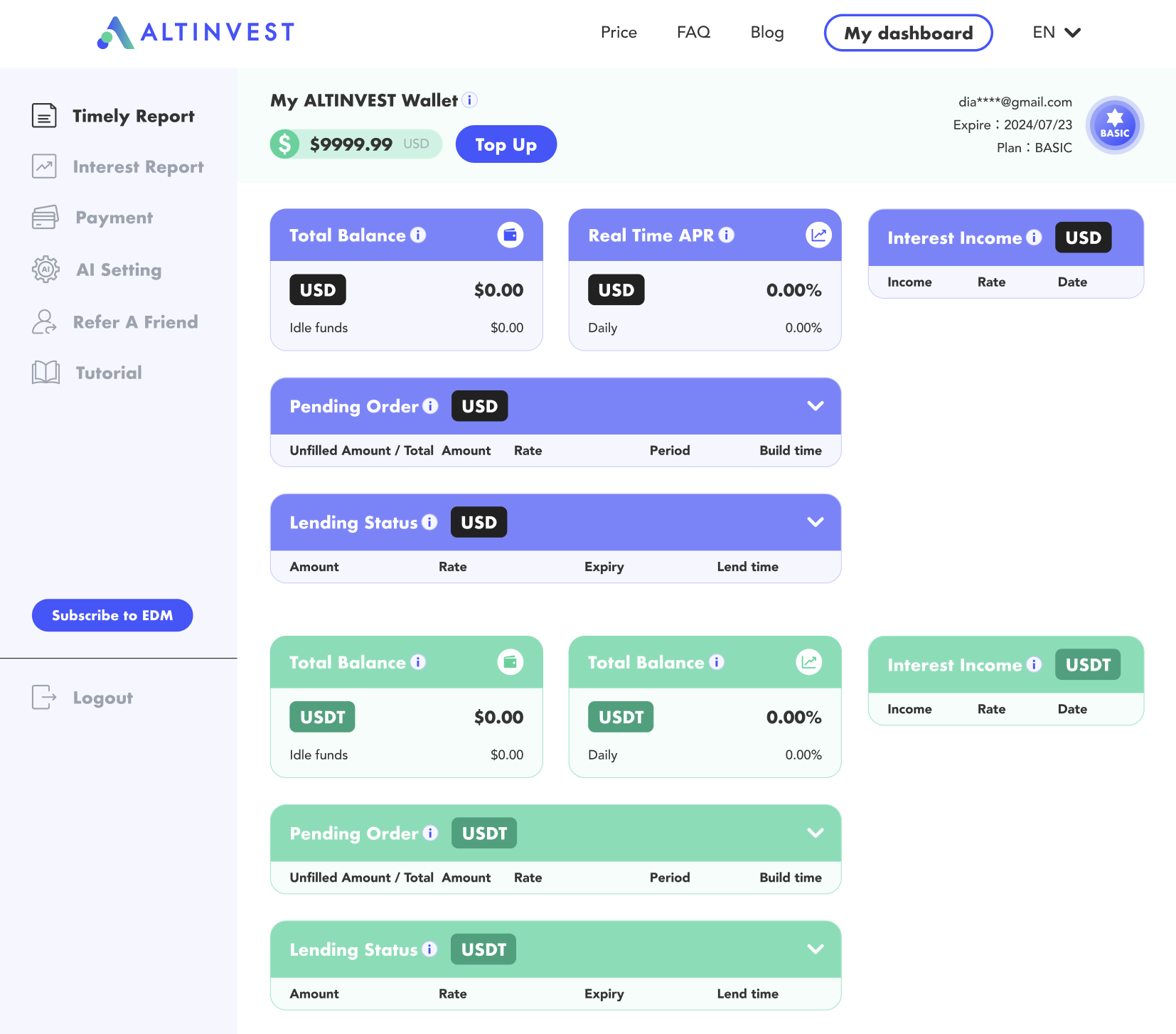

To intuitively understand lending status, many bot services provide real-time monitoring dashboards. For example, ALTINVEST users can view their own interest rate dashboards upon login. The sample interface below displays current interest rates and orders for all lent assets, allowing users to quickly grasp market interest rates and the execution status of their orders, facilitating timely strategy adjustments. Real-time monitoring enables investors to swiftly assess overall conditions—whether market rate fluctuations or their own lending performance—clearly presented on the dashboard.

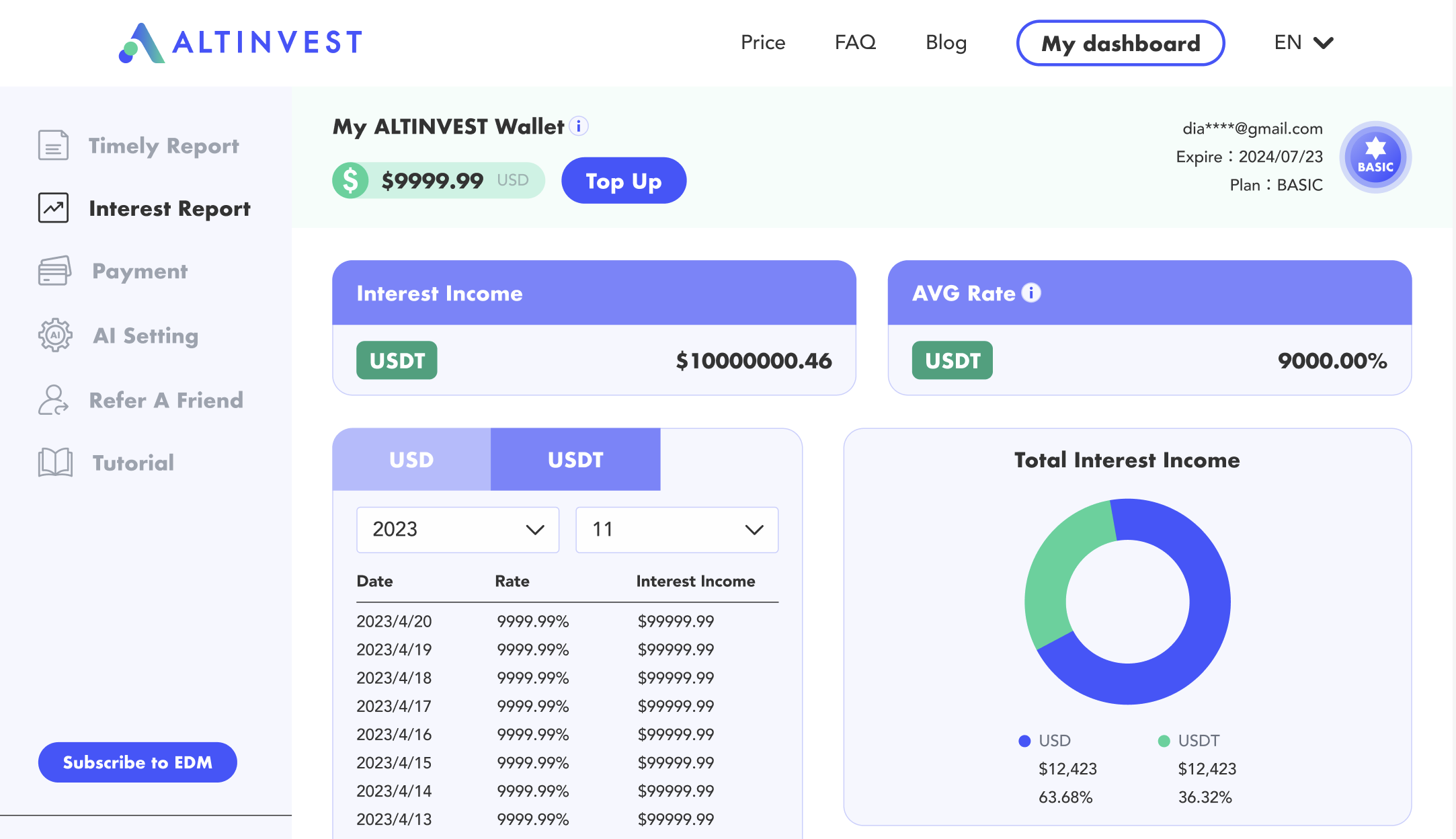

Historical Reports and Key Metrics

Besides real-time data, historical reports are vital for evaluating lending performance. Bitfinex’s platform itself offers a reporting page where users can view historical lending interest records by filtering "Margin Funding Payment" to check past earnings per loan, or users can log into ALTINVEST’s interest income reports. This helps statistically analyze actual annualized returns over different periods. Some bots extract additional metrics from these reports—such as fund utilization rate, proportion of time funds are lent out, average matched interest rate, daily interest income—and generate charts to enhance user understanding.

Alerts and Notification Settings

Finally, risk warnings and notification features can serve as important criteria when choosing a bot. Lending bots allow users to set alert conditions—for example, notify when market rates exceed or fall below a threshold, or when fund utilization is too low or too high—enabling investors to quickly detect anomalies and take action. A good alert and monitoring system should incorporate both real-time and historical data with flexible notification mechanisms, helping users comprehensively understand lending status and manage risks.

Automated Compounding Mechanism

Compounding means reinvesting earned returns into principal to generate greater future gains. Simply put, interest earned daily (or periodically) is reinvested for the next calculation, so the next day’s profit is based on a new total of “principal + previous profits.” For example, if a 3% profit is earned one day and reinvested, the next day’s 3% is calculated on a larger principal, resulting in higher total returns than two consecutive simple 3% gains. Long-term continuous compounding can significantly boost total returns. For instance, with a stable 20% annualized return, daily reinvestment leads to growth far exceeding 20% simple interest after one year. Practically, any method that increases returns has a “profit-on-profit” effect in lending; re-listing daily interest as new loans leverages market compounding benefits. Most bots have built-in auto-compounding functions to ensure every interest payment is immediately reinvested, allowing assets to grow exponentially. This is the secret to “snowballing” wealth, letting long-term investors benefit from the combination of time and rates.

Conclusion

In summary, Bitfinex lending bots typically feature a set of capabilities: dynamic interest rate strategies to boost match rates and profits (e.g., continuously lowering rates to speed lending); flexible handling of order placement and reposting to prevent idle funds; risk diversification via splitting small orders, distributing across different rates and loan durations; strict risk controls (such as pausing during market volatility); robust API performance (high concurrency, low latency, error retry); detailed monitoring and reporting; and automatic compounding features. These core elements work together to significantly improve lending performance, allowing users to enjoy substantial passive income while safely managing their capital.

When choosing a lending bot, consider these features: first, verify if it uses dynamic adjustment strategies, supports compounding, and can automatically update orders in real-time market changes. Second, check its risk management—whether it allows settings like maximum loan duration, idle rate alerts, and if it offers comprehensive monitoring and reporting interfaces to keep track of funds anytime. Lastly, consider service stability and user interface quality: high availability, concurrency performance, and user support add extra value.

Overall, a good Bitfinex lending bot should balance returns and safety—enhancing annualized profits while providing sufficient protection for funds during extreme market fluctuations.