Stablecoin Beginner's Guide: An Essential Asset in the Crypto

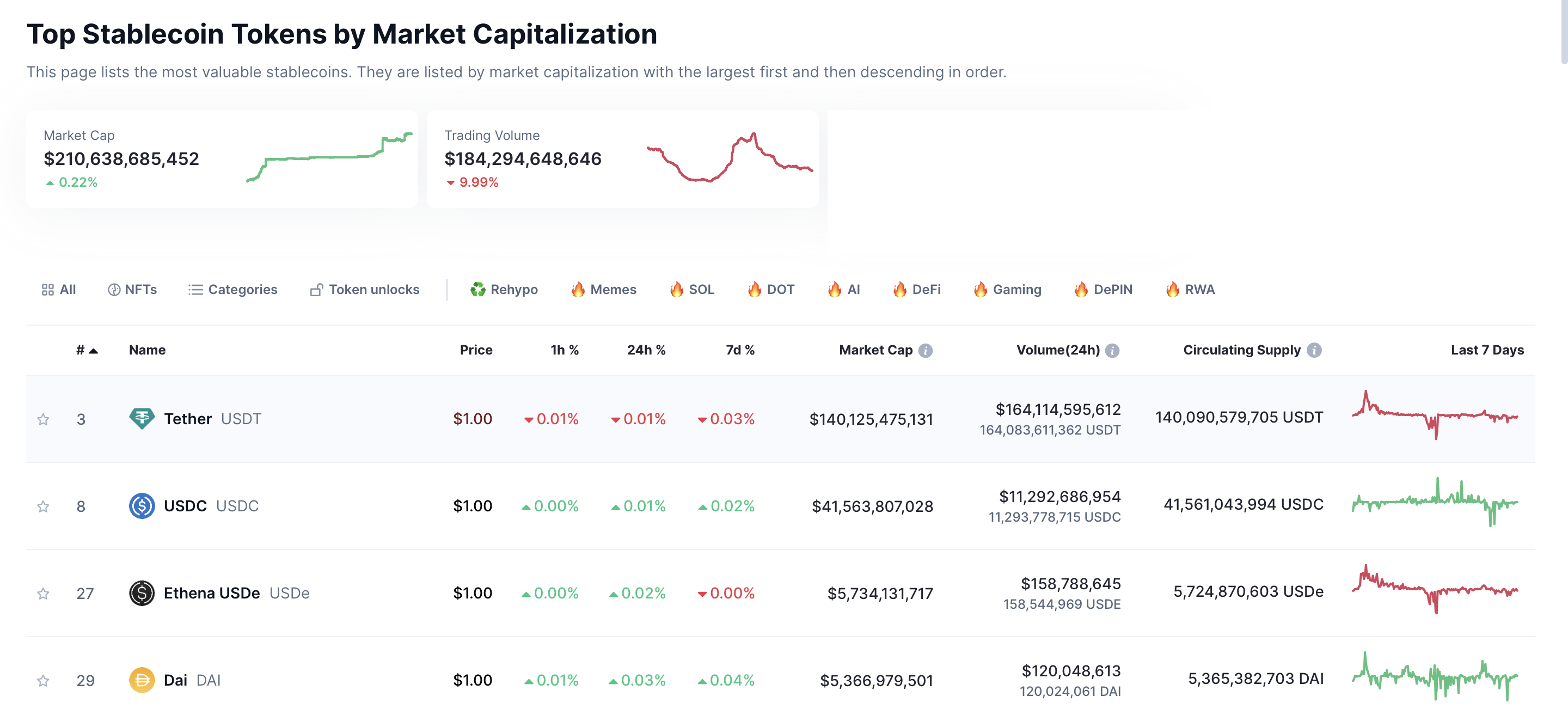

In the cryptocurrency market, volatility is a prominent feature, and the emergence of stablecoins has effectively addressed this challenge. As digital assets with stable value, stablecoins provide users with a reliable means of transaction and value storage. They not only play an indispensable role in trading and settlement but also form the foundation of many DeFi applications. Among stablecoins, the most commonly pegged asset is the U.S. dollar. Below, we will introduce several popular and highly regarded U.S. dollar stablecoins based on their rankings on CoinMarketCap, while exploring their respective characteristics and use cases.

1. USDT (Tether)

USDT, issued by Tether in 2014, is the first and currently the largest stablecoin by market capitalization, ranking only behind Bitcoin and Ethereum in the cryptocurrency market. USDT is a fiat-collateralized stablecoin, with Tether regularly publishing proof of reserves. Due to its significant market circulation, nearly all major cryptocurrency exchanges support USDT, making it the primary benchmark currency for many trading pairs. Its high liquidity and acceptance make USDT one of the most commonly used stablecoins for daily transactions in the crypto world. Users can purchase USDT directly from major centralized exchanges or exchange it on decentralized exchanges such as Uniswap. Notably, Tether and Bitfinex are part of the same corporate group, and USDT is also a currency available for lending on the Bitfinex platform.

2. USDC (USD Coin)

USDC, jointly issued by Circle and Coinbase, is a USD-backed stablecoin and the first regulated stablecoin in the United States. It is also the first MiCA-compliant stablecoin. USDC undergoes monthly audits by third-party accounting firms to ensure the integrity of its reserves. It is tradable on many major exchanges and ranks as the second-largest stablecoin by market capitalization, following USDT. USDC is increasingly popular in the DeFi sector. Users can purchase USDC on major exchanges, and many platforms provide direct fiat purchase options. Circle and Binance recently announced a new strategic partnership during Abu Dhabi Finance Week. Binance plans to integrate USDC more extensively within its ecosystem and adopt USDC as a key USD stablecoin for financial reserves, jointly promoting its adoption in commercial and financial sectors.

3. DAI

DAI, issued by MakerDAO, is a decentralized stablecoin that operates differently from other fiat-backed stablecoins. While its value is also pegged to the US dollar, DAI is backed by cryptocurrencies like Ethereum as collateral. DAI is highly popular in the DeFi ecosystem, especially in lending and liquidity provision. It is frequently used as a medium of exchange on decentralized exchanges like Uniswap and Sushiswap. Users can generate DAI through the MakerDAO platform or purchase it directly on DAI-supported exchanges like Coinbase and Kraken.

4. BUSD and FUSD

BUSD, a USD stablecoin co-issued by Binance and Paxos, was widely used within the Binance ecosystem and was once a primary trading pair on the platform. However, due to regulatory pressure in the United States, it was delisted in 2023. Binance subsequently converted all user BUSD holdings 1:1 into FUSD. FDUSD, issued by Hong Kong-based First Digital Limited, is backed by cash and cash equivalents, with reserves independently managed by a trust company and audited regularly. FDUSD is often regarded as the successor to BUSD within the Binance ecosystem, especially for participating in mining in Binance’s Launchpool.

5. PYUSD (PayPal USD)

PYUSD, a new stablecoin jointly issued by PayPal and Paxos, aims to bridge traditional finance and the cryptocurrency world. Each PYUSD token is backed by equivalent cash and short-term government securities. Currently, PYUSD is primarily used for payments and transfers on PayPal and Venmo platforms, but it has yet to gain widespread adoption in other cryptocurrency ecosystems. With PayPal’s continued efforts to expand its digital payments business, PYUSD has the potential to become an essential tool for payments and settlements.

Conclusion

Stablecoins demonstrate unique value in various application scenarios. Whether as a medium of exchange in the cryptocurrency market or a cornerstone of decentralized finance, they have become an indispensable part of the crypto ecosystem. With the gradual improvement of regulatory frameworks and advancements in technology, we can anticipate a more diversified range of stablecoin applications, further integrating traditional finance with the crypto economy. In the future, the role of stablecoins will undoubtedly grow in importance, making them a topic worth exploring and following closely.