Crypto 101: Understanding Market Cap, Volume, and Circulating Supply

The world of digital assets can be daunting, especially for beginners. If you're new to the scene, understanding some key terms like Market Cap, Volume, and Circulating Supply can lay a solid foundation and help you navigate this exciting space with more confidence. In this guide, we'll break down these terms, explaining their differences and highlighting why they're important in the crypto market.

Market Cap: What's the Big Deal?

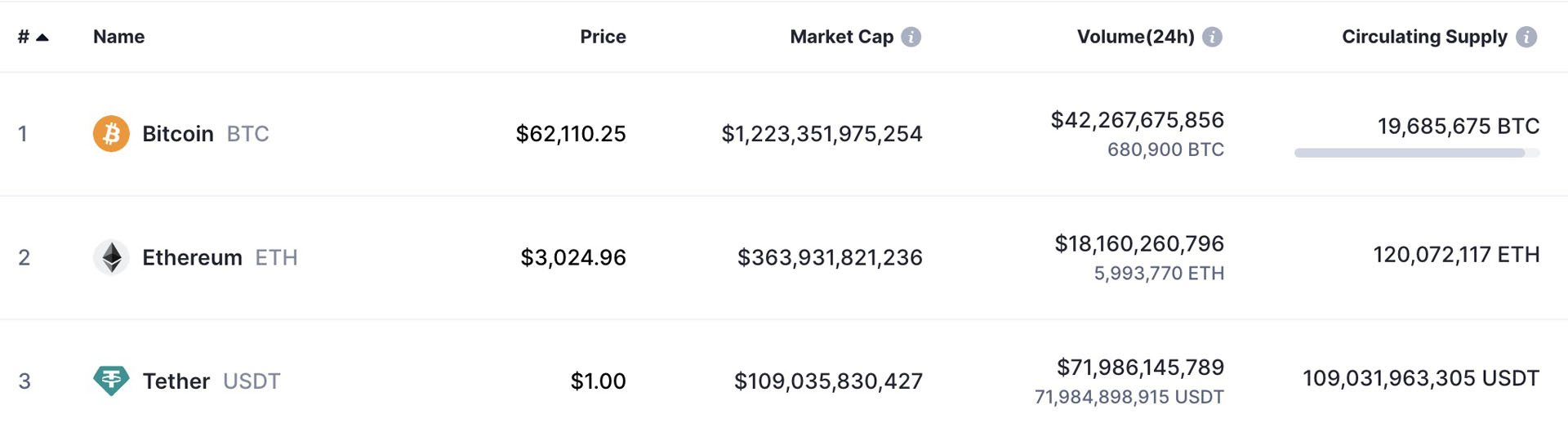

This is a widely used metric in both traditional finance and crypto markets, and for good reason. Think of Market Cap as a way to measure the importance of a cryptocurrency. Market Capitalization, or Market Cap for short, tells you how much a particular cryptocurrency is worth in total. It's like looking at the total value of all the coins or tokens of a specific digital currency.

To figure out Market Cap, you just multiply the price of one coin or token by the total number of coins or tokens in circulation. For example, if a cryptocurrency has a price of $100 per coin and there are 1 million coins available, the Market Cap would be $100 million.

- Market Cap = Price per Coin/Token * Circulating Supply

- It shows how important a cryptocurrency is in the market, and compare different projects to gauge their relative value and growth potential.

- Higher Market Caps usually mean more people are interested in that cryptocurrency.

- Bitcoin (BTC) currently holds the title for the cryptocurrency with the highest Market Cap (as of April 2024, as seen in the image above, captured from CoinMarketCap).

Volume: How Busy is the Market?

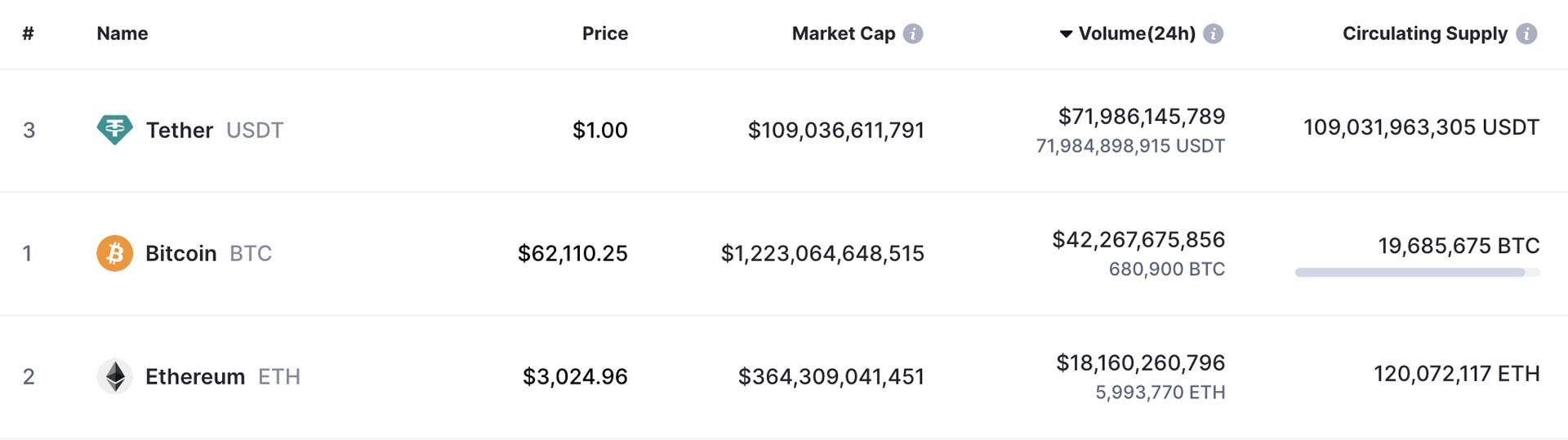

Volume tells you how active trading is for a particular cryptocurrency. It's like checking the pulse of the market to see how lively it is. This metric measures how many coins or tokens are being bought and sold within a certain time, usually 24 hours. Volume as a metric is a great way to tell if a coin is healthy, as it shows the general interest in the coin and liquidity of the market around the coin.

A high trading volume means there's a lot of action happening, with many people buying and selling. On the other hand, low volume might mean things are quieter, with fewer transactions taking place.

- Volume shows how busy the market is and how many people are trading.

- High volume usually means the market is active and prices might be changing quickly.

- Big changes in volume can indicate important market developments, like sudden price jumps or drops.

- Volume can help you decide when to buy or sell cryptocurrencies based on how active the market is. If volume is low, it means that you may need to wait longer to sell it and finding a buyer at the current market price may be difficult, or sell it at a reduced price.

- If you see volumes increasing steadily, that means the coin is growing in both popularity and liquidity and could potentially be a good investment.

- When ranked by Volume, Tether falls in first place (as of April 2024, as seen in the image above, captured from CoinMarketCap).

Circulating Supply: What's Out There?

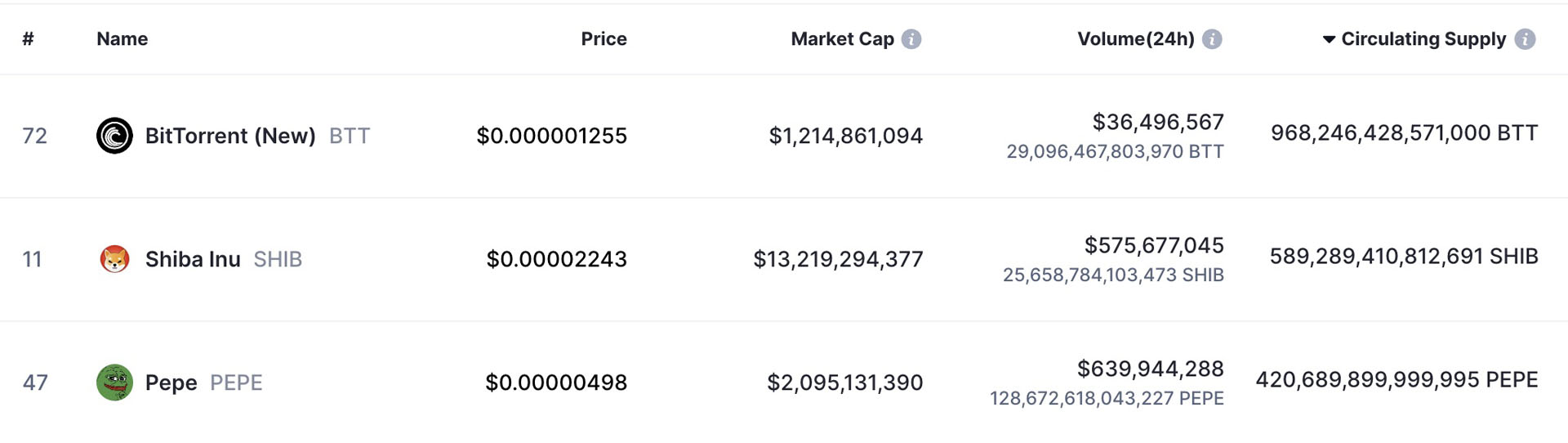

Circulating Supply tells you how many coins or tokens of a cryptocurrency are available and being used. It's like knowing how many slices of pizza are on the table to share. This metric doesn't count coins or tokens that are locked away or haven't been made yet, only those distributed to investors. This is different from total or maximum supply, which refers to the total number of coins that the cryptocurrency's protocol will ever allow it to have. By dividing the circulating supply by the maximum supply, you can find out how much of the coin has already been mined or distributed.

Circulating Supply is important because it affects how valuable a cryptocurrency is. If there are only a few coins or tokens available, they might be more valuable because they're harder to get. But if there are lots of coins or tokens out there, they might be less valuable because there's plenty to go around.

- Circulating Supply tells you how many coins or tokens are available to use.

- It affects how valuable a cryptocurrency is and how much it's worth.

- Understanding Circulating Supply helps you see if a cryptocurrency might be rare or common.

- Changes in Circulating Supply can change how people feel about a cryptocurrency and affect its price.

- When ranked by Circulating Supply, BitTorrent holds the top position (as of April 2024, as seen in the image above, captured from CoinMarketCap). It's noteworthy to observe the negative correlation between the extremely low price and extremely high Circulating Supply.

Conclusion

In summary, Market Cap, Volume, and Circulating Supply are important things to understand if you're interested in cryptocurrencies. Market Cap shows you how important a cryptocurrency is, Volume tells you how busy the market is, and Circulating Supply shows you how many coins or tokens are available. While these are great factors to consider when coming up with an investment strategy, it's important to note that they shouldn't be the sole factors considered when making investment decisions.

By getting the grips of these basic concepts, you'll be better prepared to make informed decisions about buying, selling, or holding onto your digital assets. Remember to consider other factors such as project fundamentals, technology, team, and market trends to build a well-rounded investment strategy tailored to your goals and risk tolerance.

More articles from the Crypto 101 series:

- Crypto 101: The Basics of Crypto P2P Lending - A Comprehensive Guide for Beginners

- Crypto 101 : Understanding Wallets, Private Keys, and Public Addresses

- Crypto 101 : Ways To Make Money with Crypto in 2024

- Crypto 101: A Comprehensive Crypto Glossary for Beginners

- Crypto 101: A Comprehensive Crypto Glossary for Beginners II

- Crypto 101 : A Comprehensive Crypto Glossary for Beginners III

- Crypto 101: Different Types of Cryptocurrencies